Global Rate Cuts Accelerate: ECB May Cut 6 Times Next Year

Abstract: The world is undergoing tremendous changes, with Europe continuing to decline and the Middle East rising comprehensively.

The A-share market is also experiencing significant changes, and everyone must learn the new rules.

Body: Europe has been in decline for 30 years, and the great rise of the Middle East has a significant impact on the EU.

The EU is in severe recession, which is the main reason it is considering war.

Over the past 31 years, its GDP share of the global economy has decreased by 11 percentage points.

In contrast, the United States has seen its GDP share begin to rise again after 2011, increasing by nearly 5 percentage points to date.

China, on the other hand, started to experience a slowdown in economic growth in 2011, although its share of the global economy continues to rise.

The day before yesterday, I published an article mentioning that the future king of Saudi Arabia, the "New Middle Eastern King" of the post-85s, Crown Prince Mohammed bin Salman: In the next 30 years, the Middle East will become the next Europe.

Advertisement

Saudi Arabia has joined hands with China to launch the Middle East version of "reform and opening up" - Vision 2030, dedicated to changing Saudi Arabia's dependence on the oil economy, including a large amount of infrastructure construction, and attracting global capital investment in Saudi Arabia.

At the same time, there are reforms such as women's liberation plans and reducing the intervention of religion in secular life, which have won the support of the domestic population.

Many people may doubt, but I firmly believe that this can be achieved.

Because China's urbanization has just begun.

The Middle East Arab countries have been in turmoil in the past, and now the Middle East has not only gained the support of Beijing in promoting the great reconciliation of the Arab world, but also a main reason is that the Arab world has begun to appear a new king, and there is no troublemaker.

Figures like Gaddafi and Saddam have all been eliminated, and now the most powerful is Saudi Arabia alone, under such circumstances, the promotion of the comprehensive rise of the Arab world is very much expected.

Europe is already a mess, industry is not good, agriculture is not good, technology is even less their business.

Even the aircraft industry, Airbus has been in trouble recently, and it is not much better than Boeing.

So China's great rise has given the Middle East a great opportunity.

It also indicates that the EU will face greater pressure, because the Middle East has oil and money, but the demand is mainly consumption, Europe can only supply agriculture to the Middle East.

And Europe has to consume expensive oil, in the long run, it is not enough to cover the expenses, the EU can only decline.

The EU accelerates its self-rescue and the pace of interest rate cuts accelerates!

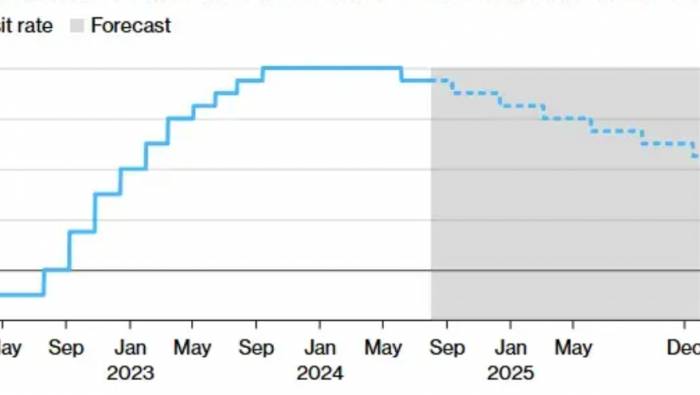

The European Central Bank is expected to cut interest rates six times next year.

Last month's data showed that the growth of the private sector in the eurozone stagnated in July, with Germany, the largest economy in Europe, still dragging down other countries in the region.

Preliminary data released by the German statistical department showed that Germany's GDP contracted by 0.1% in the second quarter.

As the central country of the EU, continuous economic contraction requires active stimulus policies, but due to the bottleneck of EU economic development, war conflicts bring inflation, which puts more pressure on the EU.

Under the expectation that the Federal Reserve will cut interest rates in September, the EU will take this opportunity to cut interest rates in advance, and under the trend of the Federal Reserve's interest rate cuts, continue to expand the magnitude of interest rate cuts.

So far, the main refinancing rate, marginal lending rate, and deposit mechanism rate in the eurozone will remain at 4.25%, 4.5%, and 3.75% respectively, and the current interest rate of the European Central Bank is at the highest level in history.

Referring to historical patterns, the European Central Bank's interest rate cuts will be faster and greater than the Federal Reserve.

So it is expected that in the next, under the expectation that the Federal Reserve will cut interest rates more than three times before the end of 2025, by the end of December 2025, the European Central Bank will cut interest rates six times by 25 basis points (a total of 150 basis points), and adjust the deposit rate to 2.25%.

However, due to the bottleneck of the EU economy and the uncertainty of the conflict between Russia and Ukraine, inflation may remain at a high level for a long time, which will bring a more lasting impact on the EU economy.

At the same time, the automotive and aircraft industries are overtaken by China, and the EU economy will be in a difficult situation.

At present, the main countries of the EU control a lot of resources in Africa.

If the situation in Africa changes, it will be a disaster for the EU.

So in the future, it is no longer in Europe.

So we can believe that the Middle East will rise peacefully with the support of China.

Wall Street issues a warning!

The Federal Reserve's interest rate cuts may not be useful.

Hartnett, known as the most accurate analyst on Wall Street, wrote in the latest Flow Show notes that the long-term high real interest rates are slowly and profoundly damaging the U.S. consumer and labor market.

Global interest rate cuts are no longer a question of "whether" or "when," but a question of "whether interest rate cuts are effective."

In the second quarter, the average interest rate of U.S. credit card accounts with interest has reached a historical high of 22.76%, and ordinary families are carrying an unprecedented high interest burden.

Hartnett believes that although the current market sentiment still tends to expect that interest rate cuts will bring a soft landing, it requires worse economic data and/or market fluctuations to break this consensus.

The consensus is: The Federal Reserve cuts interest rates → the probability of a soft landing is more than 75% → stocks > bonds, cyclical stocks > defensive stocks, large technology stocks > small-cap stocks, the United States > the rest of the world.

From my perspective, I think that for the current global economic cycle, except for India, Africa, and the Asia-Pacific region, Western countries have completed urbanization, and the United States currently relies on the influx of global immigrants to drive economic prosperity.

In the short and medium term, the United States will still enjoy this treatment.

However, when Western urbanization reaches a bottleneck, and at the same time, due to the rise of China and India, the resources controlled abroad by Western countries will also be affected, which will have a profound impact on Western countries.

The Federal Reserve's interest rate cuts are still useful for the dollar hegemony, but for countries other than the United States, without economic growth support, they will continue to face greater pressure.

Small companies and backward industries will face greater pressure.

In addition to the world undergoing tremendous changes, the stock market is also undergoing tremendous changes.

In the market of registration system, the market of marketization, small enterprises are generally not easy to get by.

Data shows that the lifespan of small and medium-sized enterprises in the United States is less than 7 years, and that of China is even shorter, with an average lifespan of less than 3 years.

The cumulative increase of the three major stock indexes in the United States over the past 10 years is very large, but the stocks that really drive the stock index are only about 10%.

This is the price of the bull market index and marketization.

There are currently 5,559 listed companies in the United States, and over the past (nearly) 50 years, about half of the companies (including delisting) have not brought returns to investors.

The number of our listed companies is about to surpass the U.S. stock market.

This week, three new shares were listed on the A-share market, and the total number of listed companies has reached 5,107.

There are currently many small-cap stocks, with the number of stocks with a market value of less than 5 billion reaching 2,988.

You know that in the past, there were no delisting years, and the smallest garbage stock market value also reached 5 billion.

But now it's reversed, and there are many fairy stocks everywhere.

This is the law and embodiment of internationalization, plus the recent rescue of the stock market, basically no longer supporting the garbage stocks, so the current rules of the A-share market are undergoing tremendous changes.

It is best to change the past way of operation in terms of operational strategy, learn more about Western rules, and find opportunities in China's A-shares.

This is also the main reason why I am now constantly telling everyone to study the growth of leading stocks.

Because it's not that the leader is not good to rise, but there are actually very few leaders in the market.

Live a Comment