Make 100B! Top Stock Guru's Picking Tips. Global Rate Cuts Looming!

Make a staggering profit of 100 billion!

The most outstanding "Stock God" teaches you stock selection in the new era.

Why do I emphasize the new era?

Because the A-share rules have changed, and the market has changed.

In the past, stocks rose and fell together, the number of listed companies was small at the beginning, and with the support of the upper limit board to prop up junk stocks, the A-shares in the past were almost all speculation on junk topics.

But it's not because those stocks were junk, but because the junk of that era could be transformed into treasure through restructuring, which is actually also a form of value investment.

Now, there are more than 5,000 listed companies in A-shares, and the number of listed companies is almost the largest in the world.

It's too difficult to find restructuring for the past junk, and there are not many restructurings, so it can't be speculated.

It's also impossible to rise and fall together.

Therefore, similar to international rules, it has entered the era of leading value investment.

What is the era of leading value investment?

It is internal friction and bottlenecks.

It means that the industry has been developed, and the customer development is over, so it's time to enter the era of grabbing customers, which is the era of mergers and acquisitions among institutions.

Advertisement

At this time, the leader has the greatest strength, which is easy to merge and acquire small companies, so it has entered the era of leaders.

Just like more than 2,000 years ago, the collapse of the Qin Empire, a large number of warlords emerged at once.

After the emergence, it began to enter the era of warlords fighting warlords, and the cycle of becoming bigger and stronger.

For thousands of years, the world has been like this.

Just like the United States today, everything it can develop has been developed, and now it can only enter the cycle of fighting opponents.

If there is nothing to do, it has to find something to fight.

All the truth is to expand the territory.

So now, A-shares are the same, you have to find leaders, find a leader in a big industry, because the space for integration in a big industry is big.

If the industry is small, it may be directly eaten by others.

Make a staggering profit of 100 billion!

The most outstanding "Stock God" teaches you stock selection.

The world's largest sovereign wealth fund, the Norwegian Sovereign Wealth Fund.

The latest disclosed data shows that in the first half of this year, the investment return rate of the Norwegian Sovereign Wealth Fund was 8.6%, equivalent to earning 147.8 billion Norwegian krone or 137.9 billion US dollars, equivalent to 100 billion yuan in RMB.

The Norwegian Sovereign Wealth Fund is the world's largest sovereign wealth fund, and it has been named the most outstanding "Stock God" by investors due to its continuous dazzling investment returns.

The latest data shows that the scale of the fund has exceeded 18 trillion Norwegian krone, equivalent to 12 trillion yuan in RMB.

In terms of holdings, as of the end of June, the scale of the Norwegian Sovereign Wealth Fund was 17.745 trillion Norwegian krone.

Among them, 72% of the funds were invested in stocks, 26.1% in fixed income, 1.7% in non-listed real estate, and 0.1% in non-listed renewable energy infrastructure.

In terms of holding distribution, at the end of June 2024, the equity investment of the Norwegian Sovereign Fund accounted for the majority of the investment in North American companies, accounting for 54.2%.

European stocks were the second largest layout, accounting for 25% of the equity investment of the sovereign fund, and the investment in Asia, Oceania and emerging markets accounted for 20.1% and 10.5% respectively.

The top ten holdings are all in the US stock market.

So in the value investment market, it is very important to speculate on the leaders.

Whether it is a big country or a small country, or an enemy country, as long as there is money, the main investment direction is to go to the leader country.

Recently, the private equity institutions with good returns and active big guys are all mainly invested in the US stock market.

Although only 10% of the US stock market has a positive return in the past ten years, global funds are still willing to find leader stocks in this 10%.

So, it is not easy to get rid of the dollar hegemony.

It is not easy to get rid of the US stock market.

It is not easy to get rid of the leader.

Value investment is to find growth leaders, this is the investment strategy taught by the most outstanding "Stock God" in the new era.

Back to A-shares, among these more than 5,000 listed companies, there are only a few masters in ten thousand, how do you find, how do you calculate, this depends on the ability.

Those who know how to find have been silent and quietly laid out.

Those who don't know how to find will only complain about the market.

But don't forget, among the more than 5,000 listed companies in the US stock market, there are only a few that have risen sharply.

Even if it has risen high, it is even more difficult to find a higher rise.

Right?

Facing the current situation, as the world's largest future economic entity, the capital market that has been oversold.

Can you say that the speculation space is smaller than other countries?

Now the global interest rate cut tide is coming, I think it's better to find leaders.

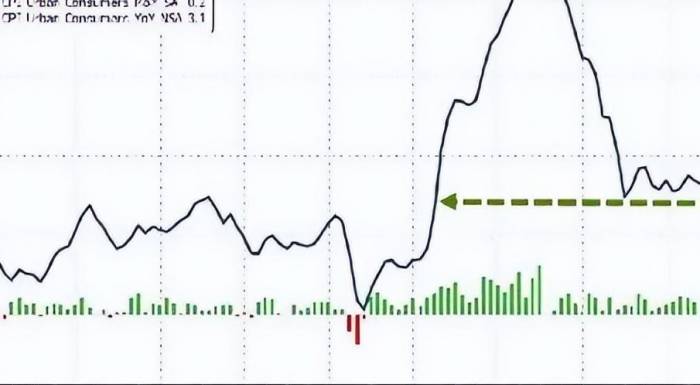

The US CPI annual rate in July is 2.9%, and the interest rate cut in September is almost a foregone conclusion.

According to the data released by the US Department of Labor on Wednesday, the specific data shows that the US unadjusted CPI annual rate in July was 2.9%, lower than the market's expected 3.0%, and it has been falling for four consecutive months; the adjusted CPI monthly rate in July was 0.2%, completely in line with expectations, and the interest rate cut in September is almost a foregone conclusion.

From my perspective, the US CPI can also be revised down.

Because in the past six months, the US non-agricultural data has been significantly revised down every month.

Under the overall revision, the US data should also be revised down reasonably.

At the same time, the signal of the US economic recession has increased, Goldman Sachs estimates that the probability of the US economic recession is 41%, and JPMorgan Chase estimates: 31%.

All these indicate that the global interest rate cut cycle has fully opened.

It is good for the emerging capital market, no, it is good for our big A, because others have all risen.

Corporate deposits continue to "move", and the scale of bank wealth management has broken through the 30 trillion yuan mark.

According to the calculation of the research team of CITIC Securities, the scale of wealth management in July this year increased by 1.78 trillion yuan month-on-month to 30.30 trillion yuan.

Specifically, fixed income products have played a leading role, and the scale has been further increased.

The data from the Banking Wealth Management Registration and Custody Center shows that as of the end of June this year, the scale of fixed income products was 27.63 trillion yuan, accounting for 96.88% of the total scale of wealth management products, an increase of 1.73 percentage points compared with the same period last year.

Ma Kunpeng, the chief analyst of the banking industry of CITIC Construction Investment, estimates that the scale of the bank wealth management market in the second half of the year will increase by 4 trillion yuan to 5 trillion yuan, and the scale of the bank wealth management market will reach 34 trillion yuan by the end of this year.

From CITIC's judgment, under the tide of interest rate cuts, the main direction of capital movement is to go to bank wealth management, not to the stock market.

However, according to market rules, if there is a market, it can stimulate capital to enter the market.

So now that the capital has not gone to the stock market, it does not mean that it will not go in the future.

As long as the long-term low interest rate continues, the hot money inside always needs to find a place with high expectations to take risks and speculate.

And the stock market is currently the only market with high liquidity.

The real estate market now believes that not many people dare to expect a few times of increase.

In the absence of a large space, stock speculation will be the main direction.

Today's news, the overall decline in the price of commodity housing has slightly expanded year-on-year.

According to the news from the National Bureau of Statistics, in July 2024, the price of commodity housing decreased month-on-month, and the overall decline in the year-on-year price has slightly expanded.

Among them, the year-on-year decline in the sales price of second-hand housing in first-tier cities continued to narrow.

In July, the year-on-year decline in the sales price of newly built commodity housing in first-tier cities was 4.2%, an increase of 0.5 percentage points compared with the previous month.

Among them, Beijing, Guangzhou, and Shenzhen decreased by 3.3%, 9.9%, and 8.0% respectively, while Shanghai increased by 4.4%.

The year-on-year decline in the sales price of newly built commodity housing in second and third-tier cities was 4.8% and 5.8% respectively, an increase of 0.3 and 0.4 percentage points respectively compared with the previous month.

In July, the year-on-year decline in the sales price of second-hand housing in first-tier cities was 8.8%, an increase of 0.2 percentage points compared with the previous month, among which Beijing, Shanghai, Guangzhou, and Shenzhen decreased by 7.2%, 5.6%, 12.4%, and 9.8% respectively.

The year-on-year decline in the sales price of second-hand housing in second and third-tier cities was 8.2% and 8.1% respectively, an increase of 0.3 and 0.4 percentage points respectively compared with the previous month.

Of course, the stock market is not going to rise together, it is impossible, or to find the growth, the main direction with a large space.

Because long-term investment, long-term holding, you have to hold for a long time, and the higher the rise, the more successful.

China's economy as a whole is brave and strong.

The National Bureau of Statistics: In July, the production of raw coal, crude oil, natural gas, and electricity in the industrial sector above a designated size grew steadily.

Overall, China's economy has performed steadily.

The US stock market is mainly technology, and the manufacturing industry is basically none.

It is equivalent to what Tencent Ma Huateng said, there is no foundation.

If China's technology goes up, and technology has a strong foundation, and the manufacturing industry also does well.

Then there is still hope in the future, great hope.

At least there is this condition, only China has it.

Live a Comment